This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

proofread

Digitalization momentum slows down post COVID

The COVID crisis has triggered a digitalization push in companies in Germany. But will this continue? IfM Bonn reports that although every third of small and medium-sized enterprises (SMEs) in Germany certifies themselves as having a "high" to "very high" digital intensity. This share is higher than the EU average.

More than one in three small and medium-sized enterprises (37%) in Germany rate their level of digitalization as "very high" or "high." The share is higher than in the EU, where only 31% state such levels. In contrast, large companies in Germany are at a similar level of digitalization compared to their counterparts in the EU.

Large companies in Germany and across the EU have a higher level of digitalization than SMEs and correspondingly employ more specialists in the fields of information and communication technology (ICT) than their smaller counterparts. Within the group of German SMEs some additional size differences can be detected: While almost every second medium-sized company (47%) employs ICT specialists, this holds only for 15% of small companies.

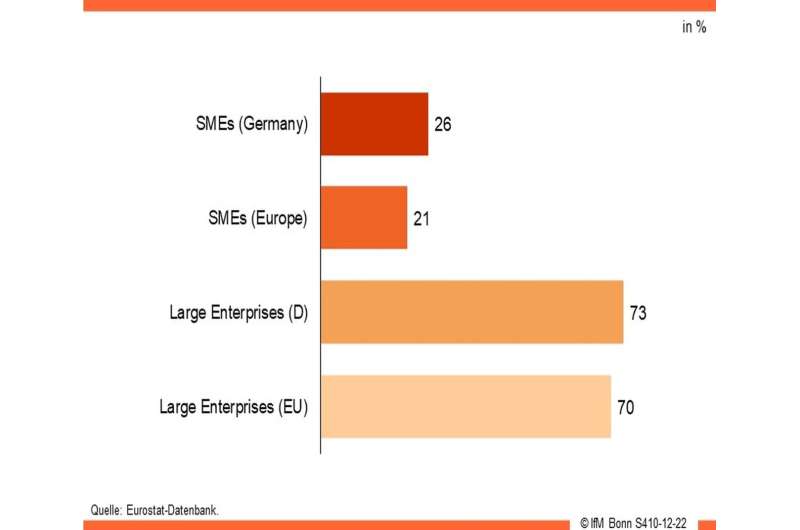

In 2022, a larger share of SMEs in Germany (26%) trained their employees in information and communication technology than the EU average (21%). Overall, however, the ICT training commitment of SMEs needs to catch up to that of large companies.

E-commerce in Germany lags in European comparison

Despite the digitalization boost in the wake of the COVID-19 pandemic, the share of SMEs in Germany (19%) that generate at least 1% of their turnover from online sales is stagnating. Leaders in the corresponding EU comparison are SMEs in Sweden (36%), Denmark (35%) and Ireland (35%). Among large German companies, the respective share fell by two percentage points to 36% compared to 2021 and is now below the EU average (39%). By comparison, in Sweden, the share of large companies that generate at least 1% of their turnover from online sales amounts to 64%, in Denmark to 63% and in Belgium to 56%.

More information: www.ifm-bonn.org/en/statistics … -kmu-im-eu-vergleich

Provided by Institut für Mittelstandsforschung (IfM) Bonn