This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

trusted source

proofread

FinTech companies true to their word after Brexit

UK FinTech firms who predicted in 2018 that they would partly relocate their UK operations to the European Union after Brexit have largely followed through with their plans, according to new research published this week in the journal Advances in Economic Geography.

FinTech, which focuses on the application of digital technology to the financial services sector, is an important growth industry worldwide, with the UK a world-leader alongside the USA and Singapore. In 2019, the London-centered UK FinTech industry generated annual revenues of £11bn, employed 76,500 people and attracted £3.6bn of investment. Researchers at Anglia Ruskin University (ARU) surveyed companies at the FinTech Connect event in London in 2018 about whether they were planning to relocate to either the EU or the USA following Brexit.

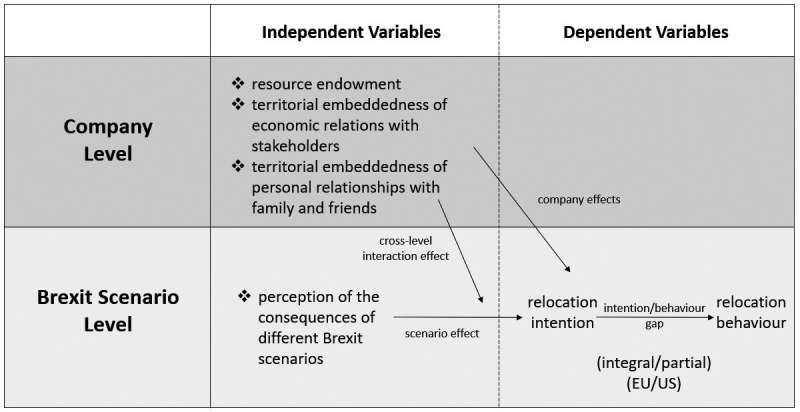

At the time, the exact nature of the UK's exit from the EU was unknown, so researchers offered three scenarios; a no deal Brexit, a Brexit with a deal negotiated between the UK and the EU; and a scenario where Brexit was canceled. In 2018, of the 38 UK-based firms surveyed, 37% felt it likely or very likely that parts of their UK business unit would be relocated to the EU if the UK left without a deal. In the event of a deal, this number reduced to 24%.

The percentage of firms planning a move at least partially to the US if the UK left the EU without a deal was 13%, or 11% with a deal. Follow-up research in February 2022 using data from company websites, LinkedIn, Companies House and Crunchbase revealed 39% of firms had opened new offices overseas without closing their UK establishment, while 13% had fully dissolved their UK establishments. Researchers found that 84% of firms had broadly followed through on their predictions, whether that was relocation, or remaining in the UK.

This number included firms who thought they would relocate fully but ended up only relocating partially, as well as firms who thought they would relocate to the EU but ended up going to the USA. The research found that, rather than firms flocking to specific EU hubs, companies that did partially or fully leave the UK for the EU tended to disperse, with destinations as diverse as Paris, Amsterdam, Krakow, Sofia and Barcelona.

However, if firms did leave for the USA, they gravitated towards New York City. Lead author Dr. Franziska Sohns, Associate Professor of Economic Geography at Anglia Ruskin University (ARU), said, "While most firms did not anticipate post-Brexit relocation, those who did saw the EU as the most important potential relocation destination, highlighting the significance of geographical and institutional proximity. Our results indicate that the Brexit was a significant push factor for UK FinTech firms anticipating relocation to the EU and, to a lesser extent, also to the US."

"We also found that firms with existing strong social and economic relations with the EU were more likely to consider relocation. Motives varied, for example one firm moved their headquarters from London to Sofia due to declining growth opportunities in the UK, while another opened an office in Malta to keep the EU passport."

More information: Franziska Sohns et al, Do they do as they say?, ZFW—Advances in Economic Geography (2023). DOI: 10.1515/zfw-2021-0049

Provided by Anglia Ruskin University