This article has been reviewed according to Science X's editorial process and policies. Editors have highlighted the following attributes while ensuring the content's credibility:

fact-checked

proofread

Why 'born digital firms' should have a physical presence in foreign markets

Firms that have their roots in selling non-physical digital products, also known as "born digital firms," can establish an international presence without ever physically setting foot in another country. But experience shows that many born digital firms are still choosing to establish a physical presence—funded through foreign direct investments—in key markets.

A new study published in the Global Strategy Journal in February 2023 highlights the role of a physical presence in foreign markets for born digital firms.

"Past research has indicated that digital technologies are highly fungible, which means that there is little relative gap in value when a resource is deployed from one market to another. Digital technologies are also said to be highly scalable, which means that the value of the resource does not decline steeply when the resource is made available to other markets. However, we argue that extending digital technologies to foreign markets can require complementary, physical resources, which are not always fully fungible or scalable," says Maximilian Stallkamp, the study's lead author who works as an assistant professor of international business and global strategy at Virginia Tech.

These complementary resources include local human resources, as well as context-specific expertise, such as sales, customer service, and stakeholder relations.

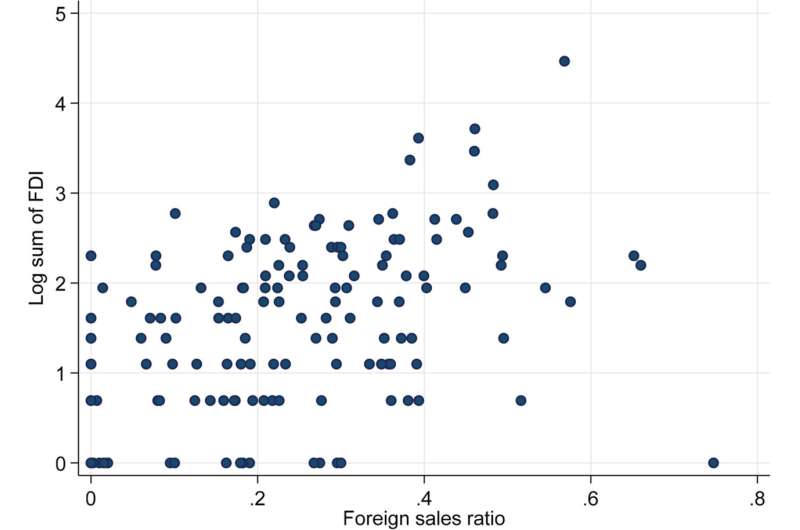

Stallkamp, along with his co-authors Liang Chen of Singapore Management University and Sali Li of the University of South Carolina, collected and analyzed data on 129 United States-based digital firms with 804 foreign direct investment projects in 39 countries. They used a conditional logic model to determine the effect of various country-specific variables, including geographical and cultural distances from the United States, on the choice of foreign direct investment location.

"Our analysis shows that born digital firms are more likely to deploy foreign direct investment in far away and culturally very different countries. This decision is made to reduce the challenges associated with large geographical and cultural distances," adds Chen, an associate professor of strategy and entrepreneurship.

These findings indicate that establishing a physical presence may be important to successfully capture the value of digital products by enabling access to local resources in distant countries. Therefore, firms and executives should carefully decide if and in which markets they must be physically present before undertaking such investment decisions.

"Ours is one of the first studies to collect and analyze systemic data on foreign direct investment by born digital firms. It provides an important empirical baseline to recent discussions of digitalization in global strategy," concludes Li.

More information: Maximilian Stallkamp et al, Boots on the ground: Foreign direct investment by born digital firms, Global Strategy Journal (2023). DOI: 10.1002/gsj.1474

Provided by Strategic Management Society