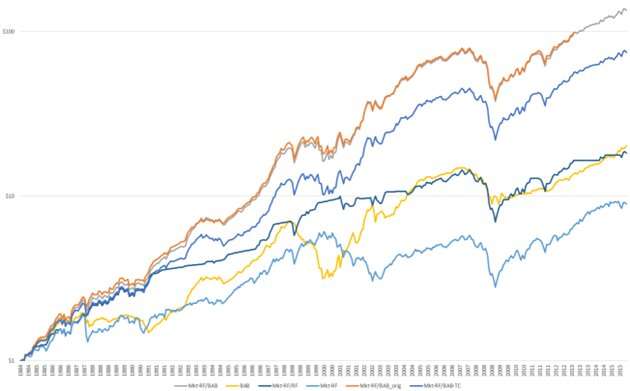

The dynamic flow-based betting against beta (BAB) strategies outperform static strategies. Credit: Thorsten Lehnert

Beta is a measure of a stock's volatility in relation to the overall market. Betting against beta (BAB) strategies have been developed that perform incredibly well for investors. The basic BAB strategy is to take a short position in assets with higher betas, and a longer position in assets with lower betas, on the grounds that higher beta assets are overpriced and the lower ones are underpriced. This approach results in large "positive alphas"—in other words, indications that the security is outperforming the market. The excellent performance of BAB strategies has generated academic interest and made them highly influential with practitioners.

In a study published in The Journal of Finance and Data Science, Thorsten Lehnert, a professor at the University of Luxembourg's finance department, shows that the strategies' exposure to non-fundamental price pressure from trading activities of mutual funds explains their success. His analysis is based on more than 30 years of flow data from bond and equity mutual funds and focuses on the US stock market.

He explains that "high and low beta stocks are differently impacted by data or activities that confuse or misrepresent genuine underlying trends, known as price noises. These noises characterize the performance of the BAB strategy over time. For example, when retail investors are caught up in the market euphoria, they are too optimistic, and equity mutual funds experience inflows, which lead to upward price-pressure and subsequent negative returns. The effect is stronger for high beta stocks, resulting in significantly lower returns. As a result, when the market performs poorly, the BAB strategy returns are significantly positive, because of the short position in high beta stocks."

Inspired by these results, Prof. Lehnert designed a dynamic trading strategy that is based on signals from past flows and BAB strategies. His strategy significantly outperforms the market factor by 0.71% on average per month. Following positive flows, this figure falls to 1.62%, while during market stress episodes, it rises by 2.14%. Accounting for transaction costs, other equity risk factors and non-standard procedures used in the BAB construction reduces the profitability of the strategy, but does not change the conclusions.

According to Prof. Lehnert, this is a great breakthrough in the field of empirical asset pricing. "Until now, the large alphas that BAB portfolios produce have been puzzling for financial economists. My explanation that a major part of the excellent performance is due to its exposure to flow-induced price noise is new and interesting. I hope that my results encourage scientists to continue investigating asset pricing anomalies."

More information: Thorsten Lehnert, Betting against noisy beta, The Journal of Finance and Data Science (2022). DOI: 10.1016/j.jfds.2022.04.001

Provided by KeAi Communications Co., Ltd.