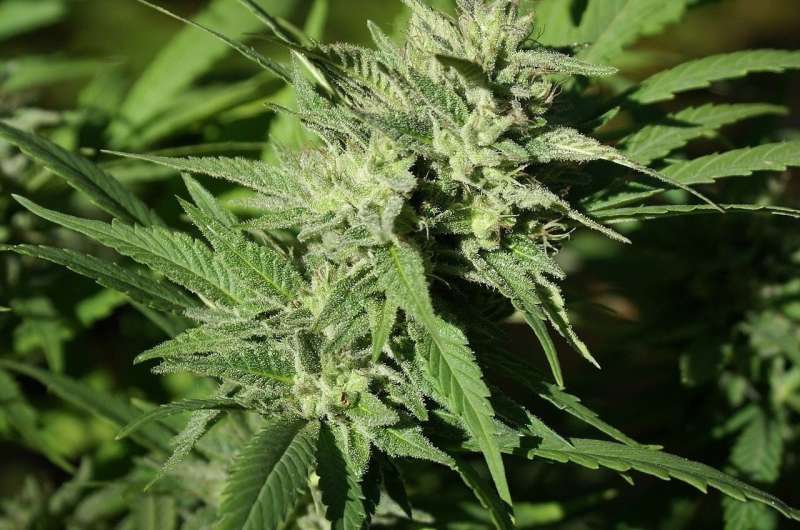

Legal cannabis vs. black market: Can it compete?

The Oct. 17 launch of legal recreational cannabis in Canada brings many challenges. Retailers are now worrying about possible product shortages or web site glitches. Governments are still debating how to handle amnesties, impaired driving, and workplace safety.

But legalization day also marks the start of several interesting competitions. Some resemble those in other industries; others are unique to cannabis.

The most important one from a public policy perspective is the competition between legal cannabis and black markets. Squeezing-out illegal suppliers is a key legalization goal.

The black market's head start

As I've noted before, it'll be tough to lure customers away from established illegal vendors. For one thing, cannabis-infused foods and drinks aren't yet legal. Black markets will monopolize those products for another year.

Dried cannabis and oils are legal now but may experience shortages. But those should disappear next year as more growers become operational.

Places to legally shop are also scarce in most provinces. Québec only has 12 stores open and Ontario won't have any brick-and-mortar stores until spring. By contrast, Alberta has a hundred stores opening this month. As store counts grow, legal cannabis will grab more market share.

Pricing also handicaps legal vendors. They must pay fees and taxes while competing with street prices around $7.20 per gram.

However, legal cannabis might eventually undercut illegal weed. Mass production is already reducing per-gram growing costs below $0.75 and is heading for $0.20. Moving production to countries with lower wages and warmer climates could drop that to $0.05.

Promotional marketing could give legal cannabis an advantage. But federal law restricts advertising to "informational" purposes; no cartoon characters or happy puppies. That makes it harder to build brand reputations.

The pre-existing "gray-market" dispensaries further complicate the legal-illegal competition. Will most close or go legit? If not, they'll provide another challenge for legal retailers.

New or established, storefront or online?

Competition is also beginning among legal vendors, especially in Alberta. Will speciality chains, independent shops or established grocers prove most popular? Will consumers prefer stores with coffee-shop vibes, clean clinical looks or retro-hippy styling?

A potentially fascinating competition pits brick-and-mortar versus e-commerce. In many retail sectors, physical stores have struggled (or gone bankrupt) against online competitors. But now we're seeing hundreds of new cannabis storefronts open, despite every province also selling pot online.

To succeed in this rivalry, cannabis store staff will need to offer good customer service. Online vendors must correspondingly provide well-designed web sites.

Privacy concerns will influence this competition. Some consumers won't want friends or coworkers seeing them buy cannabis. They'll prefer the anonymity of buying online.

Other shoppers may worry more about online privacy. Typing names and credit card numbers into cannabis web sites might lead to problems later, perhaps at the U.S. border. Some folks will prefer paying cash in physical shops instead.

Both rivalry and synergy could arise between medical and recreational cannabis. Some medical users may switch to recreational products for convenience or variety. Conversely, people trying recreational weed may find it therapeutic and later get prescriptions. Such crossovers could boost sales of both products.

Producers and products compete

The big-money competition is among cannabis producers. They've scrambled for skilled workers. They've raced to take-over greenhouses, chocolate factories, and even indoor soccer fields for growing spaces. And their stock prices have soared.

But all that's been mere warm-up. Now their recreational products and business strategies finally go head-to-head.

Whose products will prove most popular? Will most consumers opt for a mild buzz, powerful highs, or therapeutic effects? Will sales of cannabis buds and oils be eclipsed by value-added products like cannabis foods and beverages when those become available?

Which managers have built the strongest firms? What's the best strategic balance between cost reduction, distinctive branding and product research?

There's still the option (in most provinces) for consumers to grow their own cannabis. This will probably resemble home winemaking: many folks try it but few stick with it. Mind you, robotic grow-op boxes apparently can do the gardening work for you now; a cell phone app keeps you updated on the plants' progress.

Displacing other substances?

Looking more widely, we can see cannabis-alcohol competition also brewing. Some booze drinkers will switch to pot for their buzz, especially once cannabis beverages arrive. That's one reason wine and beer companies are investing in cannabis producers.

Other substances might see similar switching. There's evidence that legalizing pot reduces abuse of opioids and cocaine. Might some tobacco smokers trade their cigarettes for joints too?

Read more: Now that cannabis is legal, let's use it to tackle the opioid crisis

That brings up the even broader competition between provincial pot policies. Each government has chosen its own approach to legalizing cannabis sales and consumption.

Some provinces are keeping retailing entirely government-owned. That might bolster consumer education and harm reduction. Others are at least partly including businesses. Those may respond better to customer preferences and market trends.

The least bad policy?

Whose policy will work best? More precisely, which ones will come closest to achieving governments' varied and competing societal objectives?

Provinces with more stores per capital will dampen their black markets best. Alberta will likely lead there, given the large number of private-sector stores expected. New Brunswick's public-sector retail network also looks good relative to its population.

By contrast, Québec has just 12 government-run stores initially for 8.4 million residents. It's put tight limits on consumption. And its new premier wants the minimum age raised to 21. It's hard to see that strategy discouraging illicit dealers.

Other government decisions will also be tested. Letting municipalities ban cannabis stores may be pragmatic politically. But that lets black markets continue unabated.

Similarly, Newfoundland's desire for a local cannabis supply is understandable. But offering a $40 million tax break to get it will look expensive if cannabis surpluses eventually materialize as expected.

So, whether you're a retailer, consumer, government official or producer, you'll probably find the next few weeks challenging, interesting and constantly changing, to say the least.

Provided by The Conversation

This article is republished from The Conversation under a Creative Commons license. Read the original article.![]()