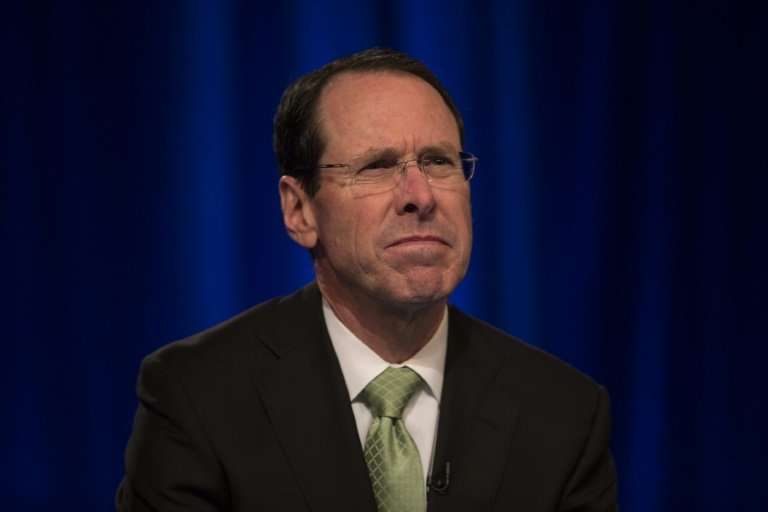

AT&T chairman and CEO Randall Stephenson is fighting a Justice Department bid to block the telecom giant's merger with Time Warner

The US government faces off in court Thursday against AT&T and Time Warner in the biggest antitrust case in decades over their bid to merge and create a powerful new television behemoth.

Opening arguments were to begin in US District Court in Washington after a snow storm triggered a one-day weather delay.

The Justice Department filed suit in November to block the planned $85 billion tieup of AT&T, a dominant telecom and internet firm, with media-entertainment powerhouse Time Warner.

Under review since late 2016, the trial will be a closely watched test of digital age anti-trust enforcement under the Trump administration.

AT&T argues the merger is needed to compete in a media landscape dominated by Big Tech giants like Amazon and Netflix.

Adding a political dimension to the trial is the feud between President Donald Trump and Time Warner unit CNN—which the White House regularly attacks as "fake news."

Unconfirmed reports have suggested the government sought the sale of CNN as a condition for approval of the merger.

Federal Judge Richard Leon, however, has refused to hear evidence showing AT&T was singled out for prosecution.

The Justice Department argues in its trial brief that the tieup would hamper competition and raise prices.

"American consumers will end up paying hundreds of millions of dollars more than they do now to watch their favorite programs on TV," government lawyers said in the brief.

AT&T argues that online platforms like Netflix have an advantage over traditional television rivals by collecting data that can be used to customize ads and content

They contend that AT&T could withhold or demand higher prices for prime television content like Time Warner unit HBO's "Game of Thrones," or sports from Turner Broadcasting.

The video 'revolution'

AT&T meanwhile argues competition concerns are overblown because the two companies operate in different segments: one is a distributor, the other a creator of content.

The deal, according to AT&T, will help competition amid "a revolutionary transformation that is occurring in the video programming marketplace."

The AT&T brief maintains the television landscape is being dramatically changed by "the spectacular rise of Netflix, Amazon, Google and other vertically integrated, direct-to-consumer technology companies."

It said a combined AT&T and Time Warner would create a stronger competitor for Amazon, Facebook, Google and Netflix.

Time Warner, according to AT&T, cannot effectively compete without a digital partner against tech giants, which can gather data for personalized ads and content.

Legal experts note that blocking the deal would go against a decades-long precedent of allowing these kinds of vertical tieups. But they are divided over the likely outcome.

In 2011, a similar merger between Comcast and NBCUniversal won court approval, with some conditions.

AT&T argues the same precedent applies to its vertical merger and evidence will show the Comcast/NBCU merger "resulted in no harm to competition whatsoever."

Most antitrust investigations are settled with an agreement calling for divestitures or other actions to preserve competition, so the court showdown represents a risk for both sides, analysts said.

© 2018 AFP