Courts of old Istanbul yield insights on modern poverty

Few might think to seek insights on Middle Eastern conflict or modern poverty in court records of the Ottoman empire. Yet when Duke University economist Timur Kuran combed through those centuries-old court documents, he made a surprising discovery with implications for modern times: The courts' actions had unintended consequences that inadvertently undercut people's finances.

In Ottoman Istanbul, court biases resulted in high interest rates for the rich and privileged. These days, Kuran says, the poor are paying the price.

A similar relationship between courts and finances is at work today, but with a twist, Kuran says. In Ottoman Istanbul, court biases resulted in high interest rates for the rich and privileged. These days, the very factors that once worked against the rich may be harming the poor, he says.

"What we see here are unintended consequences," Kuran said. "The court's intent was to assist groups considered worthy of support. The unintended consequence was to render them less trustworthy and increase their cost of borrowing."

The new paper, which appears Wednesday in the Economic Journal, is based on Kuran's close study of nearly 200 years of Istanbul court proceedings, from 1602 to 1799. Kuran, a professor of economics, political science and Islamic studies, recently edited a 10-volume collection of Istanbul court records.

The courts of 17th and 18th century Istanbul were Sharia courts grounded in Islamic law and tradition, not unlike the courts that are gaining sway in today's Middle East. At the start of the project, Kuran and co-author Jared Rubin of Chapman University knew the courts were heavily biased in favor of men, titled elites and Muslims. By contrast, they strictly punished women, commoners and religious minorities such as Christians and Jews.

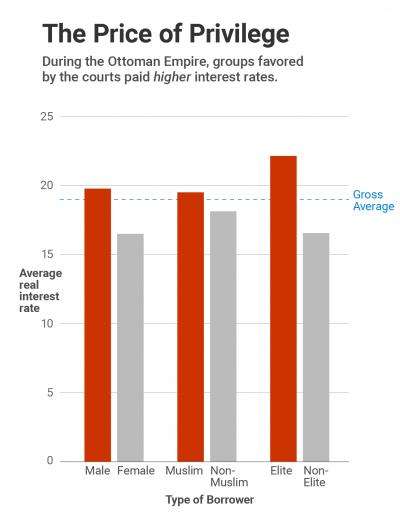

Yet as he reviewed the records, Kuran noticed that the very groups the courts favored—Muslims, men and high-status individuals—paid significantly higher interest rates for loans. Conversely, society's less fortunate—women, commoners and religious minorities—paid lower interest rates.

The reason? Because the courts went easy on Muslims, men and titled elites, lenders could not count on recouping their money and loaning to those groups became a high-risk proposition. Lenders responded by charging privileged individuals higher interest rates to cover their risk.

"The biases of the courts made it risky to lend to privileged groups," Kuran says. "The courts gave privileged groups incentives to break contracts. Judicially favored groups paid more for credit precisely because their promises were relatively less credible."

Men in particular paid significantly higher interest rates than women—as much as 26 percent more, the study states. Women represented a better credit risk precisely because courts held them accountable, Kuran says. Also, women of the time were not free to travel alone, much less flee their creditors. Men, by contrast, represented a flight risk.

The findings help shed light on the contemporary Middle East, Kuran says. For one, they help explain why the once-prosperous region fell behind Europe economically, a lag from which the region is still recovering, he says.

As the Industrial Revolution took off in the 18th and 19th centuries and factories began springing up across Britain and Europe, access to capital became increasingly important, Kuran says.

Across Britain and Europe, industrialization was financed by wealthy investors who could secure large loans. Istanbul was a thriving commercial center at the time. The high interest rates faced by the city's elites help explain why a similar industrial expansion was slower to take root there.

"To succeed in mass production, one needed much more capital than in the past," Kuran says. "So it became a handicap to face very high borrowing costs."

The type of courts Kuran studied—Sharia, or Islamic, courts—are re-emerging in many Middle Eastern countries. While such courts have been criticized from a human rights perspective, less attention has been paid to their potential financial impact, Kuran says.

"This helps explain why bringing back Sharia law is precisely the wrong medicine for this region," Kuran says.

The research also has implications beyond the Middle East, Kuran says. It may provide new insights into the dynamics of modern poverty.

In contemporary Western democracies, Kuran suggests, court biases are different than they were in the days of Ottoman Istanbul. And the poor are paying the unintended price.

Most modern bankruptcy laws protect both rich and poor and are intended to help the poor, Kuran notes. Yet for lenders, bankruptcy protection and other laws that shield the poor from prosecution make lending to the poor a riskier proposition. That may help explain why poor borrowers often resort to pay-day lenders and pawnshops that charge interest rates as high as 400 percent, Kuran says.

"Bankruptcy laws may have the unintended consequence of harming the very group they intend to protect—the poor," Kuran writes.

"In making it more difficult for lenders to recoup their losses from defaults, they raise the credit costs of the poor. Laws meant to protect the powerless thus have the unintended effect of compounding their handicaps in financial markets."

Kuran doesn't advocate the wholesale abolition of bankruptcy protections for the poor. He does believe revising bankruptcy laws could help lower the punitive rates that the poor face in credit markets, and says the topic warrants further study.

"Such laws may be one of the structural causes of modern chronic poverty," Kuran says.

More information: "The Financial Power of the Powerless: Socio-Economic Status and Interest Rates under Partial Rule of Law," Timur Kuran and Jared Rubin, Economic Journal, 2016. DOI: 10.1111/ecoj.12389

Provided by Duke University