Apple CEO Tim Cook speaks on October 23, 2012 in San Jose, California. Activist investor Carl Icahn said Thursday he would meet Cook in September and discuss the "magnitude" of a share repurchase plan.

Activist investor Carl Icahn said Thursday he would meet Apple chief executive Tim Cook in September and discuss the "magnitude" of a share repurchase plan.

Icahn made his announcement in a tweet, just over a week after he indicated he had taken a stake in the US tech giant, which he called "extremely undervalued."

"Spoke to Tim. Planning dinner in September. Tim believes in buyback and is doing one. What will be discussed is magnitude," his Twitter message said.

Icahn indicated last week he would press Apple to increase its stock buyback, in which the company purchases its own shares in a bid to boost its value.

Earlier this year, Apple yielded to pressure from the hedge fund Greenlight Capital, agreeing to return some $100 billion to shareholders over the next two years, including $60 billion in share repurchases.

Icahn told The Wall Street Journal last week that Apple could boost its share value by borrowing money and buying back shares.

"Buy the company here and even without earnings growth, we think it ought to be worth $625," he told the newspaper last week.

Apple shares, which topped $700 last September and then slumped below $400, picked up after a sluggish session to gain 01.2 percent to and close at $502.96.

Last week's news from Icahn pushed Apple's share price up nearly five percent.

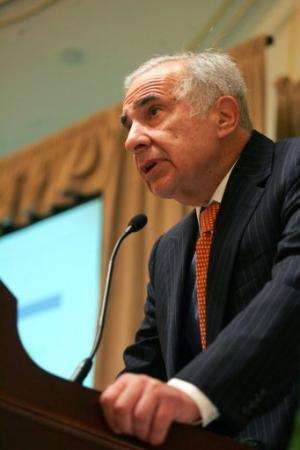

Carl Icahn speaks at a media conference on February 7, 2006 in New York City. Icahn indicated last week he would press Apple to increase its stock buyback, in which the company purchases its own shares in a bid to boost its value.

Apple is widely expected to unveil a new iPhone in September, and some reports say the company will introduce a lower-cost version of the iconic smartphone.

A recent IDC survey showed Apple's share of the global smartphone market slipped to 13.2 percent in the second quarter, from 16.6 percent a year ago, while Android's share rose to 79.3 percent.

Icahn has a long history of taking positions in companies that give him the leverage to force changes in management or rewards to shareholders, or both.

© 2013 AFP