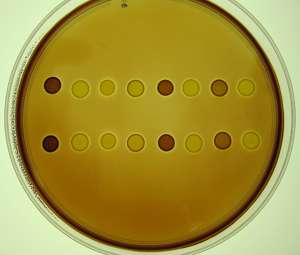

A lined up synthetic stain set with different colours indicating different investments in stress resistance (dark means more resistant).

(Phys.org) —For the first time the complex interplay between bacterial investment strategies and their outcomes has been recreated and analysed by researchers at the University of Sydney and University of Exeter.

The study is published today in the journal Ecology Letters.

Co-author Dr Tom Ferenci from the University of Sydney's School of Molecular Bioscience said, "The breakthrough was in using synthetic biology to create identical bacteria but with fixed investment strategies, some investing in growth, some in stress resistance and others in both to various degrees."

"This is the cleanest system yet that precisely defines a relationship between traded objects in a living 'market' and permits the testing of strategies in many different environments."

"Since the 1960s, theories have been available on how decision-making by organisms is related to their survival on one hand or to rapid growth on the other. Both are not possible simultaneously because resources are not sufficient for both. Bacteria, like humans, have limited resources and are constantly faced with decisions on how to invest in their future. Bacteria are hugely successful and have managed to colonise every part of the planet," said Dr Ferenci.

The researchers developed a mathematical model to predict the best way for bacteria to invest resources in a trade-off between growth and stress resistance.

"It has been believed that the decision-making process involves trade-offs that give biological investors different niches to exploit. Now we have proved it," said Dr Ferenci. "With our engineered organisms it has been possible to subject them to a range of different environments with different stresses and growth conditions. We could precisely define, for the first time, the exact nature of bacterial trade-offs."

The researchers modelled how, like humans investing in cash, bacteria trade in costly proteins to reduce their stress levels or to increase consumption and so grow faster. Evolution is the decision making process with different choices encoded in the genes. Each bacterium makes an investment decision; the bad investors fall by the wayside, the good ones survive.

Dr Ivana Gudelj, co-author from the University of Exeter, said "Combining engineered bacteria with mathematical models, we have shown that very similar investment opportunities can require different investment strategies. These strategies are constrained by the subtleties in trade-offs that are usually invisible or ignored in real markets. The study is a classic demonstration of Darwinian economics and survival of the fittest."

Dr Ferenci added, "Of course the precise control of trade-off properties now possible with bacteria is not feasible with other complex trade-offs such as in economics and national economies; it would not be very popular to fix, for example, unemployment at a high level to experimentally study its trade-off with inflation."

"Nevertheless, the information this model gives us about trade-offs and their subtleties will certainly be relevant to researchers in economics, finance and business strategy."

More information: onlinelibrary.wiley.com/doi/10 … 1/ele.12159/abstract

Journal information: Ecology Letters

Provided by University of Sydney