Men work on a natural gas valve at a hydraulic fracturing site in June 2012 in South Montrose, Pennsylvania. Hydraulic fracturing, also known as fracking, stimulates gas production by injecting wells with high volumes of chemical-laced water in order to free-up pockets of natural gas below. The process is controversial with critics saying it could poison water supplies.

North America's shale oil and gas boom has shifted the balance in global energy markets, giving the US and Canada new leverage as exporters, despite the Middle East retaining a pivotal role.

While Canada has long been a major energy exporter, the rise of shale-based hydrocarbons has meant a crucial change for the United States, which could move from the being world's leading importer of oil to a net exporter by 2017.

It has become the gold rush of the 21st century, with tens of billions of dollars in revenues and hundreds of thousands of new jobs.

"That revolution is real," said Marvin Odum, President of Shell Oil, at a recent Platt's conference in New York.

"America suddenly has a 100 year supply of natural gas 'in the bank' and the world has 250 years—thanks in part to breakthroughs in the technology that unlock hydrocarbons from tight rock and shale."

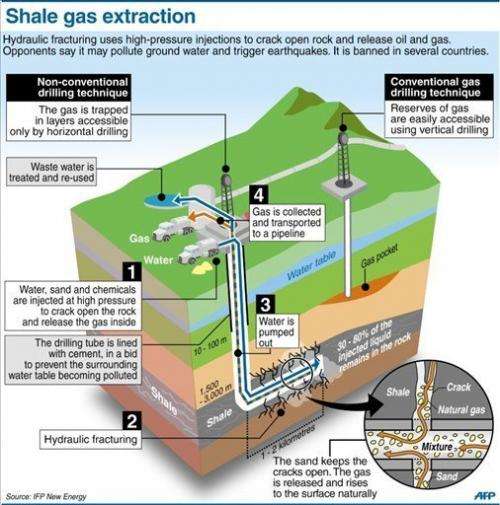

Since 2007, the technology of hydraulic fracturing, or "fracking," combined with horizontal drilling, has made possible the cost-effective exploitation of immense oil and gas resources locked up in subterranean shale strata.

The technology, also called "unconventional" production, remains highly controversial, with widespread, serious worries for the environment and the health of people living near the fracking locations.

But the impact has been stunning. In five years US crude oil production has risen 32 percent. In 2012 alone, it has jumped 14 percent from the previous year, to 6.4 million barrels a day.

The US Department of Energy says it could rise to 7.1 million barrels a day next year.

At that pace, the International Energy Agency predicts that the United States could become the number one producer of oil by 2017, surpassing current leaders Saudi Arabia and Russia.

And the US could become totally energy-independent by 2030.

Explanation of the controversial technique of shale gas extraction by hydraulic fracturing

"For natural gas, independence is almost here," said Andrew Lipow, an independent energy analyst.

Only a few years ago such a shift was unimaginable for the United States, where dependence on imported energy has been a longtime political and security issue.

The shale boom is quickly shifting the geopolitics of oil. It reduces US exposure to the whims of the long-powerful Middle East oil producers and the Saudi-led OPEC cartel.

The Middle East now finds itself faced with two challenges, according to Kevin Massy, an energy security expert at Brookings Institution.

First, they face new competition from non-OPEC rivals in North America and elsewhere whose new production is hitting the world energy market.

And secondly, their own production is threatened by rocketing domestic consumption, Massy said.

Tempering all that is the general rise in global energy consumption, that assures that much of the new production can be absorbed into the markets.

According to the International Energy Agency, the global demand for natural gas should rise by 50 percent by 2035, and the demand for crude oil 10 percent.

Most of that demand growth will come from emerging economies, who will support the price of oil at elevated levels.

Greater independence does not mean the United States will be insulated from the markets, Massy said, since the global oil market is very fluid.

"The US is still exposed. If there is a supply disruption in Saudi Arabia and Kuwait, that... has an impact on oil prices in the United States even if US doesn't import."

The reality is that the Mideast will still be supplying much of the world's energy, just not so much to the US market, said Michael Levi of the Center for Strategic and International Studies.

"The Mideast is still critical to energy supply; that will not change," Levi said.

British police stand guard while demonstrators protest against hydraulic fracturing for shale gas outside the Houses of Parliament in London on December 1, 2012.

On the other hand, because it is harder to transport and market, the natural gas business is more regionalized, making the geopolitical impact of shale gas more important.

Fracking means countries like Ukraine, Poland, and Hungary, dependent on Russian gas, could develop their own, or buy liquefied natural gas from other countries exploiting new shale fields.

"If unconventional gas production spreads around the world, the traditional producers will see their influence erode, especially Russia versus Europe," said Massy.

Development though has been slow outside North America. Environmental concerns are blocking fracking in France and Bulgaria, and the issue is still under debate in Britain.

In Poland the government has supported shale field development, but there the giant ExxonMobil is grinding its teeth over poor exploration results.

China too has important shale energy reserves. But some are in heavily populated areas, and others in very arid regions, making exploitation difficult. Fracking uses of large amounts of water.

(c) 2012 AFP