"Investment in new plant and equipment could help pick up the slack from reduced government expenditure, boosting payrolls and providing a much-needed jolt to economic activity," says UMD researcher Jeffrey Werling. Credit: UMD

U.S. corporations have far less cash on hand to invest than popularly believed - but enough to provide a significant economic stimulus and renewed employment growth in the midst of a tepid economic recovery, concludes a new study by University of Maryland economic researchers.

The study projects that if corporations invested their "excess" cash reserves in capital projects, it could generate as many as 2.4 million jobs over the next three years.

"We estimate that non-financial corporations are holding about $508 billion in excess cash, about one-fourth the size of the 'cash hoard' figures regularly thrown around in the U.S. media," says University of Maryland economist Jeffrey Werling, executive director of the Inforum Research Center. "However, this is still more than three percent of gross domestic product (GDP). Spending even a fraction of these cash reserves on capital investment could substantially boost economic growth and employment."

The Inforum study was commissioned by the UN's International Labour Organization (ILO) as part of its Global Employment Trends 2012. The ILO asked Inforum to project how increased corporate investment could help accelerate the U.S. recovery.

"It's not surprising that U.S. industry would be tight-fisted given the highly uncertain economic environment, but the consequence is a low level of total investment, economic growth and job creation," Werling explains.

"Now, as government fiscal austerity hampers U.S. economic growth, new private spending becomes essential to close the employment gap," he adds. "Investment in new plant and equipment could help pick up the slack from reduced government expenditure, boosting payrolls and providing a much-needed jolt to economic activity."

PROJECTIONS

Using its dynamic model of the U.S. national economy, the Maryland team estimated that expenditure of all the $508 million cash reserve in industry operations across three years starting in 2012 could:

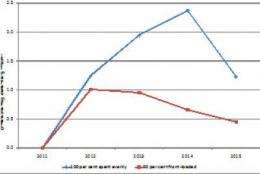

This shows the impact of increased investment on US Employment, millions of jobs, 2011 - 2015. See larger graph here: http://ter.ps/d8 Credit: Inforum/UMD

Add an additional 2.4 million jobs by 2014, reducing the unemployment rate 1.5 percent; Increase U.S. GDP one per cent in 2012, 1.5 per cent in 2013, and 1.6 per cent in 2014.

A more conservative assumption that only half of the excess cash reserves are spent on capital investment creates more than 1 million new jobs over 2012 to 2013, the study finds.

INFRASTRUCTURE BANK

A second scenario envisions creation of an "Infrastructure Bank" into which companies could invest a portion of their cash. Bank deposits would support infrastructure investment projects throughout the economy.

A key feature is the introduction of a tax amnesty program for companies' overseas cash, enacted with a requirement that repatriated funds be invested for three years in an infrastructure bank. These resources would be made available to support a variety of public infrastructure improvement projects throughout the economy. The assumption is that investment in state, local, and federal structures would increase by a total of $250 billion between 2013 and 2016.

This investment is projected to boost GDP about 0.8 per cent in 2014 and 2015, providing employment for an additional 1.1 million workers, the study concludes.

CASH HOARD ESTIMATE

Inforum estimated excess cash holdings among U.S. corporations by comparing current and historical ratios of liquid assets to current liabilities. The current ratio was found to be more than 14 percent greater than the historical average, implying that $508 billion of cash holdings are beyond levels needed for normal operations.

More information: The full Global Employment Trends 2012 report can be found on the ILO web site: ter.ps/d7. The Inforum study is reported on page 51. See excerpt here: ter.ps/d8

Provided by University of Maryland