Researchers harness a powerful new source of up-to-date information on economic activity

Researchers at the University of Michigan, University of California Berkeley, and Arizona State University have developed a new data infrastructure for measuring economic activity.

The infrastructure uses aggregated and de-identified data on transactions and account balances from Check, a mobile payments app, to produce accurate and comprehensive measures of consumers' spending and income on a daily basis.

In a paper appearing in the July 11 issue of Science, economists Michael Gelman, Shachar Kariv, Matthew Shapiro, Dan Silverman, and Steven Tadelis report precise measures of how spending responds to the arrival of paychecks and government benefits.

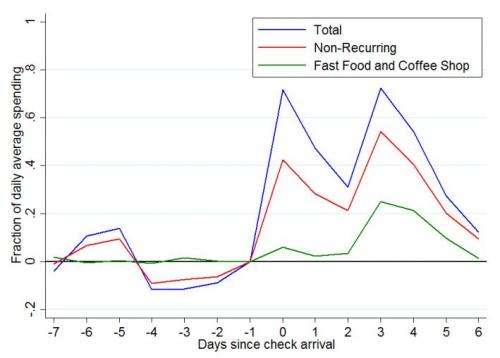

They find that relative to other days of the month, spending jumps on the day that payments arrive and remains high for several subsequent days. [See figure at url above.] For most people this jump is not because they have difficulty managing their money. Instead it reflects the convenience of paying large, recurring bills right around paydays. The data reveal that non-recurring spending, especially at fast food restaurants and coffee shops, is quite smooth across days of the month.

The research, which was supported by the Alfred P. Sloan Foundation, aims to use data generated by households and businesses in the course of their normal activities to produce economic and demographic measurements that can augment existing measures that are currently generated from surveys. These innovative measurements hold the promise of improving the timeliness, frequency, accuracy, and scope of data available for understanding economic activity.

"The way government agencies and research organizations collect data must innovate to capture the huge amount of information generated by households and businesses as they go about daily economic activity," says Shapiro, a professor at the U-M Department of Economics and a research professor at the U-M Institute for Social Research (ISR).

"Traditional surveys are becoming increasingly costly to implement given the reluctance of individuals to respond. Naturally-occurring data, whether from accounts or social media, have the potential to reduce respondent burden, reduce the cost of data collection, and improve data quality while protecting the confidentiality of individuals. Survey reports of income, spending, and assets are typically subject to significant errors. Surveys should focus on data such as expectations, preferences, and attitudes that are inherently subjective rather than asking respondents to transcribe information that is readily available from electronic records."

"The data generated by online and mobile financial applications such as Check, as well as data from social media, online marketplaces, and ecommerce sites, can be analyzed to address questions that policymakers, firms, and individuals must answer to make better decisions," says Tadelis from UC Berkeley's Haas School of Business.

Questions that can be addressed with naturally-occurring data include:

- How does individuals' spending respond to arrival of income?

- Why do individuals get tax refunds? Do they use tax refunds to spend, save, or pay debt?

- Are spending and income rising or falling? Is the economy at a turning point?

- What is the response of the economy to shocks such as the 2013 government shutdown?

Having accurate economic measurement this precise and this timely should help policymakers, according to Shapiro.

In contrast with official data that often lag by weeks, months or longer, naturally-occurring data can be available almost immediately, he points out. Policymakers such as the Federal Reserve Board need to be prepared to make decisions in response to rapidly changing economic activity. The precision of the estimates provided by naturally-occurring data sheds new light on the response of individuals to economic stimulus. Gelman et al. find that much of the apparent excess sensitivity of spending to receiving payments is due to the timing of recurring spending. Therefore, the response of the economy to fiscal stimulus such as tax rebates is likely to be smaller than previous estimates imply.

More information: "Harnessing naturally occurring data to measure the response of spending to income," by M. Gelman et al. www.sciencemag.org/lookup/doi/ … 1126/science.1247727

Journal information: Science

Provided by University of Michigan