How independent boards, managerial discretion, CEO tenure affect shareholder wealth

Yes, Virginia, there is greed. Greedy managers. Corporate greed. Greedy behavior. In fact, a web database search shows you can find such phrases in the business press over 18,000 times, confirming the subject's popularity in everyday media. But you need not fear greed, Virginia, because believe it or not, you can moderate it.

In a forthcoming article in the top-ranked Journal of Management, new research by University of Delaware assistant professor Katalin Takacs Haynes examines the effects of greed on shareholder wealth and looks at whether various contextual factors, like a strong board of directors, CEO tenure and discretion make the situation better or worse.

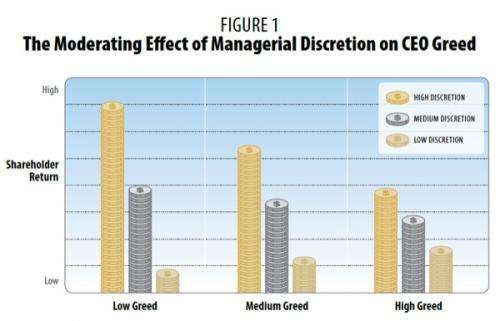

The findings? Although the pursuit of extreme wealth by top managers can lead to lower performance and loss of shareholder value, a powerful board or long CEO tenure can moderate the relationship between greed and shareholder return.

To come to this conclusion, Haynes worked with co-authors Joanna Tochman Campbell of the University of Cincinnati and Michael A. Hitt of Texas A&M University to conduct an analysis of over 300 publicly traded firms from multiple industries, examining stock market returns and dividends and conducting interviews with a set of top executives and an independent panel of experts—including academic scholars and senior business executives—from a variety of disciplines.

They also examined CEO cash compensation to that of the next most highly paid executive in the firm, as well as CEO "overpayment," or the portion of the CEO's total pay that exceeds what could be explained by factors like a firm size, prior performance and firm risk.

"Self-interest is OK but eventually it reaches a tipping point," said Haynes. "When it is taken to the extreme—when it becomes greed—it is detrimental to firm value."

Haynes added, though, that a key piece of the puzzle is to understand that managers are not uniformly greedy as the popular media can sometimes suggest, rather they differ in their pursuit of material wealth.

"Some CEOs appear to direct more of the firm's resources toward themselves than others and this can occur more when managers have a lot of discretion or have a short tenure, or if the board is weak," said Haynes. "Interestingly, we found that the negative effects of executive greed on shareholder wealth decrease as CEOs experience more time in their role."

Arriving at a definition of greed was also important to Haynes and her coauthors because in the academic world—the world where future generations of executives are taught business ethical and managerial behavior—the term remains largely undefined.

"It's not that greed has never been discussed—there are studies about wealth and selfishness, hubris and power, some even related to the excesses that led to the recent economic crisis," said Haynes. "But many rationalize the writings of Adam Smith, the father of capitalism, to mean that the unbridled self-interest of individuals creates value, from which society benefits universally. Yet Adam Smith was also a moral philosopher who differentiated between greed and self-interest, and warned against excess in his writing."

"Further," said Haynes, "the popular business press, while often invoking greed, fails to circumscribe or define it." The result is a blurred line between self-interest and greed, and Haynes and her team wanted to find a way to measure that.

After two rounds of external validation from interviews with senior business executives and analysts from a variety of industries, the researches arrived at a definition of greed as the desire for and pursuit of extraordinary wealth.

"There was a unanimous opinion of our interviewees that wealth didn't need to be realized for greed to exist, and that high level of wealth was not the same as greed," said Haynes. "It's the desire for and active pursuit of extraordinary wealth that is associated with greed."

It should be pointed out, added Haynes, that while employees at all organizational levels may have the desire for extraordinary wealth, they may not be in a position to pursue it, while top-level executives are more likely in a position to pursue and even realize wealth.

Haynes and her co-authors are currently working on a follow-up study in which they investigate the effects of leaders' greed and hubris in three entrepreneurial contexts. They theorize that while greed and hubris are probably universal and lead to the loss of human and social capital, they show up differently in different settings, such as small startups, family firms and corporate ventures.

More information: "When More Is Not Enough: Executive Greed and Its Influence on Shareholder Wealth." Katalin Takacs Haynes, Joanna Tochman Campbell, and Michael A. Hitt. Journal of Management, 0149206314535444, first published on June 4, 2014

Provided by University of Delaware