Twitter faces critical earnings test

Twitter releases its first earnings report since a wildly successful stock offering on Wednesday, in what is being seen as a critical test for the popular messaging platform.

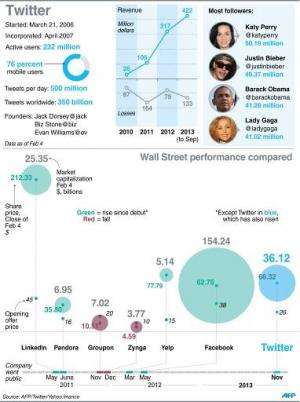

Shares in Twitter have soared from the offering price last November of $26, and analysts say that to sustain that momentum Twitter must prove it can grow and move toward profitability.

Twitter shares rose 1.6 percent to $66.32, their highest level since December.

Because Twitter has never delivered a profit, analyzing its value is a tricky task.

Wall Street expects Twitter to report continuing losses in the fourth quarter. But analysts will be scrutinizing the results for gains in advertising revenues, Twitter's user base and other metrics that measure "engagement," or how people use the platform.

Mark Mahaney at RBC Capital Markets remains upbeat with an "outperform" rating on Twitter.

"We remain positive on Twitter's ability to become one of the Web's leading utilities (alongside Google, Amazon, Facebook)," he wrote in a note to clients.

"Twitter has displayed very robust growth in key metrics, and we have confidence that this momentum can continue as the company develops its advertising platform... we remain enthusiastic about the company's long-term opportunity."

Twitter has fast become engrained in popular culture but must still convince investors of its business model, having lost more than $440 million since 2010.

With 232 million users and growing, Twitter is expected to be able to reach profitability over time by delivering ads in the form of promoted tweets, and from its data analytics. The research firm eMarketer estimates Twitter will bring in nearly $1 billion in 2014 in ad revenues.

But analysts at Cantor Fitzgerald recommend "sell" for Twitter saying its valuation is "excessive," seeing "more downside than upside short-term."

The Cantor Fitzgerald analysts said even with strong advertising and other gains, Twitter could face pressure because more shares will come on the market after the "lock-up" expiration that prevented insider sales so far.

Arvind Bhatia at Sterne Agree says in a note to clients that Twitter is likely to show gains in users, revenue and engagement but that he remains "neutral" on the stock.

"We continue to like the Twitter platform and believe in the company's long-term prospects," he said. "However, we remain neutral given the stock's significant premium to its high-growth peers."

Morgan Stanley's Scott Devitt, who rates Twitter as "underperform," said investors should carefully listen to management's plans.

"We look for management commentary to focus on providing insight related to Twitter's user growth and engagement, while discussing new product developments that could drive future revenue initiatives, especially in targeting offline TV ad dollars," he said.

A more mainstream Twitter?

Devitt said Twitter must address issues of advertising, especially on mobile, and that he wants to know "How does Twitter plan to accelerate user growth and make Twitter more mainstream?"

Paul Ausick at 24/7 Wall Street said Twitter may be riding the coattails of Facebook, which posted strong results last week and buoyed the social media sector.

"Without Facebook's big earnings report last week, it is probably fair to say that Twitter stock would be trading at about seven percent below where it is trading today," Ausick said in a blog post.

"Should Twitter fail to meet estimates on Wednesday, company management could have a lot of explaining to do."

© 2014 AFP