As Twitter flies, fears mount on bubble (Update)

Twitter's high-flying Wall Street debut drew attention to the growing power of social media, but it has also raised concerns about a potential bubble in the sector.

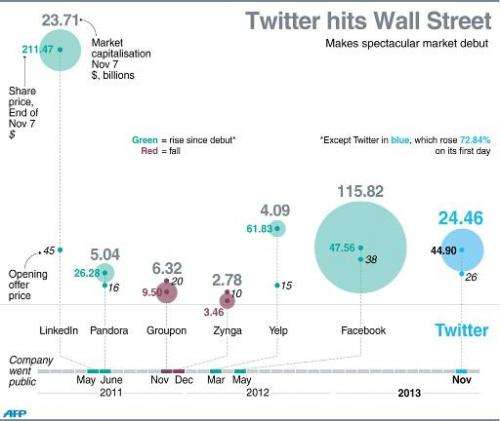

Opening day gains on Thursday of more than 70 percent after its initial public offering (IPO) stirred memories for some of the dot-com boom and bust of the late 1990s.

Even some admirers of the popular messaging platform said the outsized gains were unsustainable and that investors should bail out.

Some of the enthusiasm faded on Friday. Twitter shares fell 7.26 percent to close the week at $41.65. The shares had jumped 73 percent on Thursday from the $26 opening price to close at $44.90.

Daniel Ernst at Hudson Square Research issued a "sell" recommendation, saying Twitter is "more than fully valued," and priced at 600 times its projected earnings before depreciation and other charges.

"One cannot argue the market does not 'get' Twitter," Ernst said.

"There seems to us no upside scenario not already more than included in Twitter's implied growth outlook... We believe too much emphasis in the public discussion on Twitter's valuation has centered on softer metrics like sales and users (eyeballs), and not enough on profits."

The splash from Twitter has sparked talk of IPOs from rivals such as Pinterest, the photo-sharing social network, and Square, a payments platform for mobile devices led by Twitter co-founder Jack Dorsey.

The research firm Dealogic said 41 US listed technology or Internet IPOs have raised $7.8 billion so far in 2013.

That is down from $20.5 billion in 25 deals last year at the same time, although Facebook accounted for $16.0 billion of that. The peak full year was 1999, when 373 IPOs raised $39.9 billion, the research firm said.

Analysts are divided on whether the market has become overheated.

"It is reminiscent of the dot-com bubble, but this time the companies seem real, so it isn't clear to me that the bubble will break," said Michael Pachter, head of equity research at Wedbush Securities, who follows emerging tech companies.

"Facebook and LinkedIn have demonstrated that there is power to these models."

Still, Wedbush issued a "neutral" recommendation for Twitter, with a price target of $37—well below the opening day close.

Wedbush's report said Twitter is "in the early innings of its growth" and "has barely scratched the surface of its potential user base."

But Pachter wrote that the "valuation is extremely difficult" because of uncertainties about growth in advertising, and Twitter's costs in marketing and research.

"We think that an early investment in driving increased usage will pay dividends in future years, but we aren't prepared to forecast positive net income for next year," he wrote.

Lou Kerner at the Social Internet Fund said it's not fully clear who will be the winners and losers in this emerging sector.

"We're in a period of time where investors are more focused on the upside opportunity than the risk," Kerner told AFP in an email.

"While the significant global social media opportunities will enable the great companies to grow into their valuations and beyond, the weaker companies, those that misstep, will see their valuations crushed."

Mary Jo White, head of the US Securities and Exchange Commission, expressed concern this week over the overzealous interest of investors—lured by huge numbers of users of social media—in tech stocks with uncertain profitability.

"Our staff's concern has been the impact on investors of the sheer magnitude of some of these metrics," such as the number of users, she said in a speech.

Twitter has fast become engrained in popular culture but must still convince investors of its business model, having lost more than $440 million since 2010.

But with 232 million users and growing, it is expected to reach profitability by delivering ads in the form of promoted tweets, and from its data analytics.

Trip Chowdhry at Global Equities Research, who has been skeptical about Twitter's valuation, said it is "a great company" but it is too optimistic to assume massive growth in social media use around the world.

"There are a finite number of people on the planet and only 24 hours in a day," he said.

He said Twitter's valuation based on its financial data should be no more than around $8 billion, compared to $22.6 billion, based on Friday's closing price.

"They need to show they can execute on revenue growth and profitability in the next one or two years," Chowdhry told AFP.

"Twitter is a bubble by every metric. When you are in a bubble stock you don't want to be the last one to get in."

© 2013 AFP