Icahn revamps Dell offer, urges rejection of buyout (Update)

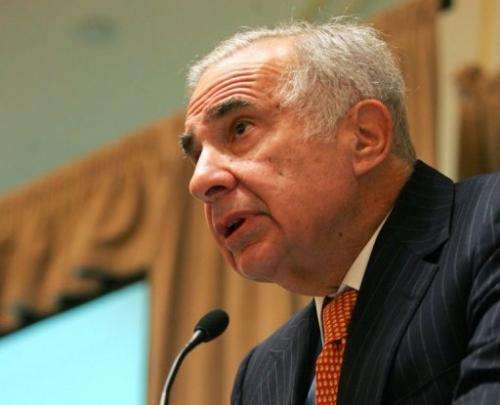

Corporate raider Carl Icahn revamped his proposal Tuesday for embattled computer company Dell, calling for a big share buyback in a plan which would keep the company public.

Icahn, who has lambasted a go-private plan led by founder Michael Dell as undervaluing the company, said he and his investor allies would vote against that proposal and urged shareholders to consider his alternative.

Under his plan, Dell would make a tender offer for $14 per share for approximately 1.1 billion Dell shares.

The offer is intended to account for approximately 72 percent of shares outstanding, Icahn said.

The price of such an offer would top the $13.65 per share offered by Michael Dell and investment fund Silver Lake Partners that would take Dell private in a $24.4 billion transaction.

"Our proposal allows those who believe, like us, that the $13.65 price being offered in the Michael Dell/Silver Lake going private transaction significantly undervalues Dell, to continue to hold Dell shares," said Icahn in an open letter to shareholders.

The special committee of the board of Dell, set up to consider the go-private buyout and other transactions, dismissed Icahn's latest proposal for its lack of detail on how the share buyback would be financed.

"Mr. Icahn's current concept would likely force shareholders to continue to own shares in the highly leveraged company that would result," the Dell special committee said.

"There is neither financing, nor any commitment from any party to participate, nor any remedy for the company and its shareholders if the transaction is not consummated."

Absent such detail, "the Special Committee continues to recommend the pending, fully financed $13.65 per share cash sale transaction."

Those criticisms were similar to the points made by the special committee in response to Icahn's last proposal. The committee faulted the previous Icahn plan, to pay out a special dividend to shareholders, for having a $3.9 billion potential funding shortfall.

In that plan—the second of the corporate raider's proposals for Dell— Icahn proposed to grant shareholders $12 a share from Dell's cash and new debt and retain their equity stake.

His letter Tuesday said he was working to obtain $5.2 billion of senior debt financing to be made available to Dell.

A major investment bank has agreed to $1.6 billion in funding and Icahn and his affiliates would supply an additional $2 billion, Icahn said.

Icahn meanwhile disclosed that he has purchased 72 million additional shares from Southeastern Asset Management, which has also been active in Icahn's campaign.

Together, the two own approximately 13 percent of Dell shares now. Icahn said.

Dell unveiled plans to go private in February, giving founder Michael Dell a chance to reshape the former number one PC maker away from the spotlight of Wall Street.

The move, which would delist the company from stock markets, could ease some pressure on Dell, which is cash-rich but has seen profits slump, as it tries to reduce dependence on the slumping market for personal computers.

The special committee on June 5 endorsed the Michael Dell proposal "as the best option for shareholders."

Icahn reiterated his call for shareholders to reject the go-private proposal at a July 18 special meeting to vote on the plan.

© 2013 AFP