New, rigorous assessment of shale gas reserves forecasts reliable supply from Barnett Shale through 2030

A new study, believed to be the most thorough assessment yet of the natural gas production potential of the Barnett Shale, foresees slowly declining production through the year 2030 and beyond and total recovery at greater than three times cumulative production to date. This forecast has broad implications for the future of U.S energy production and policy.

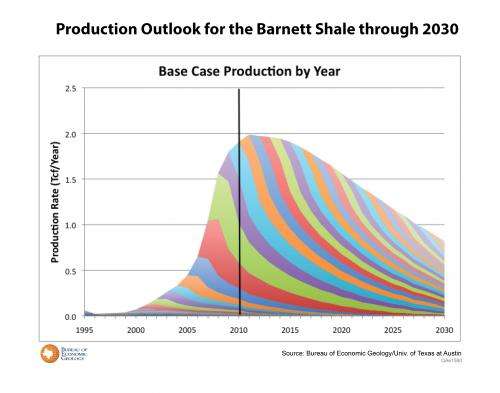

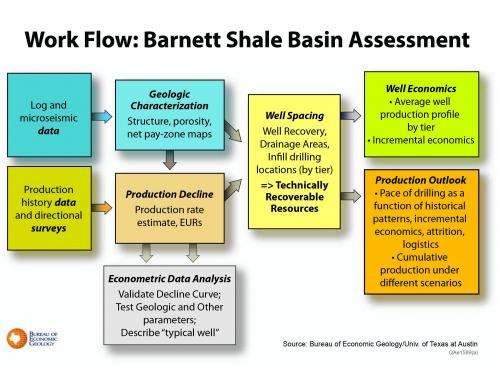

The study, conducted by the Bureau of Economic Geology (BEG) at The University of Texas at Austin and funded by the Alfred P. Sloan Foundation, integrates engineering, geology and economics in a numerical model that allows for scenario testing based on many input parameters. In the base case, the study forecasts a cumulative 44 trillion cubic feet (TCF) of recoverable reserves from the Barnett, with annual production declining in a predictable curve from the current peak of 2 TCF per year to about 900 billion cubic feet (BCF) per year by 2030.

This forecast falls in between some of the more optimistic and pessimistic predictions of production from the Barnett and suggests that the formation will continue to be a major contributor to U.S. natural gas production through 2030.

The Bureau of Economic Geology will be completing similar studies of three other major U.S. shale gas basins by the end of this year.

The BEG study examines actual production data from more than 16,000 individual wells drilled in the Barnett play through mid-2011. Other assessments of the Barnett have relied on aggregate views of average production, offering a "top down" view of production, says Scott Tinker, director of the BEG and co-principal investigator for the study.

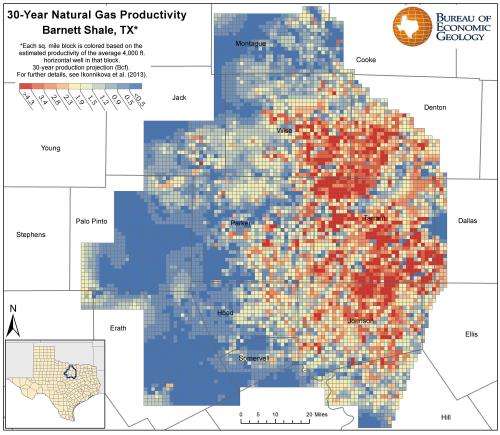

The BEG study, in contrast, takes a "bottom up" approach, starting with the production history of every well and then determining what areas remain to be drilled. The result is a more accurate and comprehensive view of the basin. The BEG team enhanced the view by identifying and assessing the potential in 10 production quality tiers and then using those tiers to more accurately forecast future production. The economic feasibility of production varies tremendously across the basin depending upon production quality tier.

The study's model centers around a base case assuming average natural gas prices of $4 for a thousand cubic feet but allows for variations in price, volume drained by each well, economic limit of a well, advances in technology, gas plant processing incentives and many other factors to determine how much natural gas operators will be able to extract economically.

"We have created a very dynamic and granular model that accounts for the key geologic, engineering and economic parameters, and this adds significant rigor to the forecasts," said Svetlana Ikonnikova, energy economist at the BEG and co-principal investigator of the project.

Whereas thickness and porosity affect the reserves greatly, price is a dominant factor affecting production. While the BEG model shows the correlation between price and production, it suggests that price sensitivity is not overly dramatic, at least in the early phase of a formation's development. This is because there are still many locations to drill in the better rock, explains Tinker, which is cost effective even at lower prices.

"Drilling in the better rock won't last forever," says Tinker, "but there are still a few more years of development remaining in the better rock quality areas."

The data in the model stop at the end of 2010, after approximately 15,000 wells were drilled in the field. In the base case, the assessment forecasts another 13,000 wells would be drilled through 2030. In 2011 and 2012 more than 2900 wells were actually drilled, in line with the forecast, leaving just over 10,000 wells remaining to be drilled through 2030 in the base case. Wells range widely in their ultimate recovery of natural gas, a factor the study takes into account.

A new method of estimating production for each well, based on the physics of the system, was integral to the project and should offer a more accurate method of forecasting production declines in shale gas wells. This method, along with several other components in the work flow, has been submitted in several manuscripts to peer-reviewed journals.

The papers have already undergone a form of professional peer review built into the BEG research process. Before submitting the papers to journals, the BEG team invited an independent review panel with members from government, industry and academia to critique their research. At an open day for academics and industry scientists, 100 attendees were invited to offer additional feedback. Scientists and engineers from two of the larger producers in the Barnett—Devon Energy and ExxonMobil—offered critical feedback on the methodology during two in-house corporate review days. Finally, the BEG hired a private consulting firm to individually critique the draft manuscripts and offer suggestions for improvement of the work.

Overall, the rigorous assessment of the country's second most productive shale gas formation reaffirms the transformative, long-term impact of shale and other unconventional reservoirs of oil and gas on U.S. energy markets.

Tinker compares the expansion of hydrocarbon reserves from shale gas to the expansion of global oil reserves from deep-water exploration that has happened in the past several decades.

"Drilling into unconventional reserves is potentially analogous to offshore oil in terms of impact," Tinker says.

More information: Frequently Asked Questions - BEG Barnett Shale Assessment Study

Provided by University of Texas at Austin