October 31, 2011 report

Facebook value gets tougher look

(PhysOrg.com) -- For most technorati ineligibles, it seemed like Wacky Math in the way that dollar signs were being placed on the value of startups in the heyday of the first dot.com bubble. When the bubble burst everyone hoped lessons would be learned and that the technobubble would be the last. Considering any week's frenetic business blog headlines this year of IPOs, IPO rumors, and seeded guesstimates about valuations, obviously not.

Zynga, Groupon, LinkedIn, and others have jockeyed for headlines in the past but Facebook remains the poster child of highly valued, online winners. Some say Facebook is worth anywhere from $65 billion to 100 billion. How to prove or disprove the guesstimates? Are the numbers based on anything real? Are they just a reminder that social networking sites are most difficult to value, where if you talk a good game you convince people that the numbers will stick?

Two researchers have the answer. According to their investigation, the truth is in the middle. Yes, Facebook can be valued mathematically. No, Facebook isn’t worth those sky-high numbers. It is overvalued and the true figure is way less.

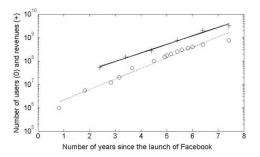

That is the conclusion of two authors from the science and technology university, ETH Zurich. Professor and risk scientist Didier Sornette and Peter Cauwels, a senior researcher at the ETH Zurich, show how Facebook is going through an S-shaped curve, where it will plateau.

One might even be tempted to think that Facebook will one day hook most people around the world but the exponential nature of Facebook’s growth of the past cannot continue.

The company has reported over 800 million users as of September this year.

Cauwels and Sornette, in their investigation, say that Facebook will either plateau at a base case of 840 million, a high growth case of 1.1 billion or a case of extreme growth reaching 1.8 billion users within a few years. Facebook's growth will probably fall somewhere between the base and high growth scenarios.

Cauwels and Sornette accordingly proceed to calculate a value for the company based on the prospect of each user generating $1 profit per year, the approximate.average over the last five years. This gives a value in the base case of $15 billion, in the high growth case of $20 billion and in the extreme growth case of $33 billion.

The authors point out that the above valuations are at the top end of reasonable calculations. Facebook will need to improve its profit per user by between 1.5 and 6 times if the current valuations are to be achieved.

Not all academics see Facebook’s valuation the same way. A professor of marketing at Wharton, Peter Fader, has in the past called the valuing of social network sites the Wild West, an area that has been notoriously fickle. “It's not like search engines, where you can really compare them on objective criteria," he has said. When asked recently about his thoughts on the Cauwels and Sornette paper, Fader said "The math is interesting, but it's mute about a lot of important things." Customer retention can have a huge influence on a firm's value, he remarked.

More information: Quis pendit ipsa pretia: facebook valuation and diagnostic of a bubble based on nonlinear demographic dynamics, arXiv:1110.1319v1 [q-fin.PR] arxiv.org/abs/1110.1319

Abstract

We present a novel methodology to determine the fundamental value of firms in the social-networking sector, motivated by recent realized IPOs and by reports that suggest sky-high valuations of firms such as facebook, Groupon, LinkedIn Corp., Pandora Media Inc, Twitter, Zynga. Our valuation of these firms is based on two ingredients: (i) revenues and profits of a social-networking firm are inherently linked to its user basis through a direct channel that has no equivalent in other sectors; (ii) the growth of the number of users can be calibrated with standard logistic growth models and allows for reliable extrapolations of the size of the business at long time horizons. Illustrating the methodology with facebook, one of the biggest of the social-media giants, we find a clear signature of a change of regime that occurred in 2010 on the growth of the number of users, from a pure exponential behavior (a paradigm for unlimited growth) to a logistic function describing the evolution towards an asymptotic plateau (a paradigm for growth in competition). We consider three different scenarios, a base case, a high growth and an extreme growth scenario. Using a discount factor of 5%, a profit margin of 29% and 3.5 USD of revenues per user per year yields a value of facebook of 15.3 billion USD in the base case scenario, 20.2 billion USD in the high growth scenario and 32.9 billion USD in the extreme growth scenario. According to our methodology, this would imply that facebook would need to increase its profit per user before the IPO by a factor of 3 to 6 in the base case scenario, 2.5 to 5 in the high growth scenario and 1.5 to 3 in the extreme growth scenario in order to meet the current, widespread, high expectations.

© 2011 PhysOrg.com