US firm investing billions in crisis-hit chip industry

Despite the economic slump that has battered the semiconductor business, a new player from the United States' Silicon Valley technology belt is investing billions of dollars in a bid to catch the next wave of growth.

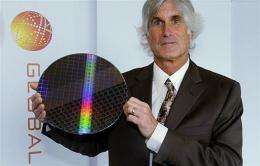

GlobalFoundries, formed in March, will focus on making next-generation chips, which it hopes will accelerate competition in a global foundry market dominated by Taiwanese and Singaporean firms.

The company will spend 3.3 billion dollars to build a manufacturing plant in New York's Saratoga County, which will be fully operational by 2012. Another 2.7 billion dollars will be invested to upgrade its operations in the German city of Dresden and boost overall processes as well as sales, marketing and design activities.

Full production at the plants should come progressively on stream just in time for an economic rebound, company executives say.

"If we start working with customers this year, it won't be until 2010 before they start manufacturing with us. So who knows what the economic climate is going to look like in 2010?" GlobalFoundries chief executive Douglas Grose told AFP in an interview.

"Our view is that it's going to start to turn and the timing is such that our investments will be ready," he said.

"When you are sitting at the bottom of an economic thing it may not look good. But in reality the timing is good."

Grose was in Singapore as part of a global tour to meet with potential clients.

The firm plans to blaze ahead by making smaller and higher-performance chips in the range of 45, 32 and 28 nanometres, leaping from the current standard of 90 and 65 nanometres, Grose said.

"I think this is a game-changer," said Grose.

A nanometre is a metric unit of linear measure that equals one-billionth of a metre. Hundreds of these nanometre-sized semiconductors, popularly known as chips, can fit in the width of a single strand of human hair.

Chips are used in most electronic devices and systems but wary consumers worldwide are buying fewer electronic goods and analysts forecast chip sales to further contract this year before starting a feeble recovery in 2010.

GlobalFoundries says long-term growth prospects remain strong, driven by a rising number of firms outsourcing manufacturing to independent foundries -- companies like itself that make custom chips for clients.

But the company faces an uphill battle against Taiwan Semiconductor Manufacturing Company (TSMC), United Microelectronics Corp (UMC) also of Taiwan, Singapore's Chartered Semiconductor and other established foundries.

One of its main shareholders, US firm Advanced Micro Devices (AMD), is locked in a dispute with Intel Corporation over what Intel said is a breach of a 2001 patent cross-licensing agreement.

GlobalFoundries is a spinoff of AMD's manufacturing operations, and AMD is currently its main client.

The other GlobalFoundries shareholder is Advanced Technology Investment Company, oil-rich Abu Dhabi's investment vehicle in the high-tech sector.

"Intel believes that GlobalFoundries is not a subsidiary under terms of that agreement and so can't be licensed under its terms to manufacture products that use Intel intellectual property," said Shane Rau, a research director with industry consultancy IDC.

"That needs to be worked out," he told AFP.

GlobalFoundries' other challenge is convincing major semiconductor firms that do not have their own wafer fabrication plants to switch sides.

"Even though GlobalFoundries will have AMD as a customer to generate early revenue, over time, GlobalFoundries will have to prove its independence from AMD in order to gain the confidence of other potential leading-edge customers," Rau said.

Grose said his company offers a choice.

"In any industry, there's got to be alternatives and we're going to provide some choice to customers on the leading edge," he said.

He also said he was encouraged after his initial meetings with potential customers.

"Is it a bad time to invest? I think it is a good time," he said.

(c) 2009 AFP